Ker & Downey

Welcome to Our Travel Blog

An African Safari with Ker & Downey

Dreaming of Africa? Ker & Downey helps you narrow in on which countries to visit on your next Africa safari by answering your most frequently asked questions.

Read MoreRecent Articles

Kid's Safari Packing List

Wondering what to pack for your child’s safari adventure? This kid’s safari packing list covers all the essentials for a stress-free, fun-filled trip.

Kenya Family Safaris

A Kenya family safari is a transformative experience. Here's everything you need to know to start panning your family safari to Kenya.

The Wildlife Retreat at Taronga

Experience an unforgettable overnight with Australian wildlife at the Wildlife Retreat at Taronga. Enjoy luxury eco-accommodation, exclusive animal encounters, and breathtaking views—all while supporting vital conservation efforts.

Six Reasons to Travel to Uganda

It may be small, but Uganda has so much to offer. Here are six reasons to go on a luxury Uganda safari.

The World's Most Exclusive Primate Safaris

Primate trekking, especially to see mountain gorillas in their natural habitat, is a thrilling adventure many travelers have on their bucket lists. It isn’t a typical wildlife experience. It’s an immersive experience that brings about a profound sense of awe, connection, and accomplishment.

Tokyo Foodie Tour

Join us on a Tokyo foodie tour of Michelin-starred restaurants, hidden soba gems, and plant-based fine dining—paired with exclusive cultural experiences and luxury sightseeing in Japan’s vibrant capital.

Personalized Thailand Experiences Off the Tourist Circuit

Discover an unforgettable Thailand experience, blending serene landscapes, authentic cultural encounters, and exclusive adventures. From the tranquil canals of Bangkok to the remote Kayan village in Mae Hong Son, these curated adventures unveil the country’s hidden treasures.

Rwanda Travel Guide

Rwanda is a small country that packs a big punch, delivering on incredible landscapes, equally incredible wildlife, and welcoming people. Within this Rwanda travel guide, you’ll find all the information you need to start planning your trip to the land of a thousand hills.

Uganda Travel Guide

Uganda captivates travelers with its untamed wilderness and vibrant culture. This travel guide equips you with everything you need to know for an unforgettable safari adventure, from the best times to visit and must-do activities to travel tips and packing essentials.

Guide To Rwanda’s National Parks

Rwanda’s remarkable journey of recovery and resilience is showcased through its four major national parks: Volcanoes, Gishwati-Mukura, Akagera, and Nyungwe. These parks, each with its unique history, have been central to the nation’s conservation efforts, transforming Rwanda into a beacon of environmental stewardship and a premier ecotourism destination.

Revenge Travel is Out: Here's What's Replacing It

Revenge travel may be over, but meaningful journeys are just beginning. Discover how to travel responsibly and luxuriously with Ker & Downey.

Luxury Safari Lodges in Kenya: Our Curated Picks

Discover the best luxury safari lodges in Kenya for front-row views of the Great Migration. From exclusive tented camps to family-friendly escapes, experience the Masai Mara in comfort and style.

The Great Migration in Kenya

When to Go, What to Expect, & How it Differs from Tanzania

The Ultimate Guide to a Luxury Safari in Kenya

Discover the best time to visit, what to pack, top luxury lodges, and unforgettable experiences in this complete guide to planning a luxury safari in Kenya.

The Best Age For Children to Travel Internationally

Traveling with kids isn’t just possible, it’s an opportunity. In this guide, we’ll explore the ideal age for traveling with your kids and some of our favorite destinations for the best family adventure.

Where to Go on Safari: Kenya’s Best Parks and Private Conservancies

Discover where to go on safari in Kenya with this expert guide to national parks and private conservancies.

Freedom in the Saddle: Mongolia by Horseback

Writer and adventure traveler Lesley McKenzie embarks on a horseback journey through Mongolia’s Gorkhi-Terelj National Park.

Beyond Adelaide: Discovering the wines and wonders of Adelaide Hills and McLaren Vale

Ker & Downey product manager Vanessa Niven recounts a whirlwind tour of some of South Australia’s best wineries and the property she’s dreaming about returning to.

Why Now is the Perfect Time to Rediscover China

For travelers seeking an unparalleled blend of history, culture, and luxury, there has never been a better time to explore China.

Polar Opposites: Guide to The Arctic and Antarctica

Elizabeth Frels outlines the key differences—and similarities—between the Earth's most unexplored regions.

The Rhythms of the Serengeti

The Serengeti’s beauty unfolds in a breathtaking rhythm of wilderness, wonder, and timeless adventure.

Polar Products and Packing Guide

Quality gear is critical when visiting the coldest place on Earth. We recommend bringing these items with you on your once-in-a-lifetime expedition to Antarctica or the Arctic.

Sarara Camp

Ker & Downey's Luxury Travel Expert Mary Jean Eraci finds luxury and exclusivity in the northern reaches of Kenya at at Sarara Camp.

Vistas Among the Vines

Ker & Downey's Katie Conover embarks on a journey through Chile and Argentina's finest wine valleys and estates.

From Screen to Scene: Exploring Iconic Filming Locations

Discover the real-world destinations that bring your favorite on-screen stories to life.

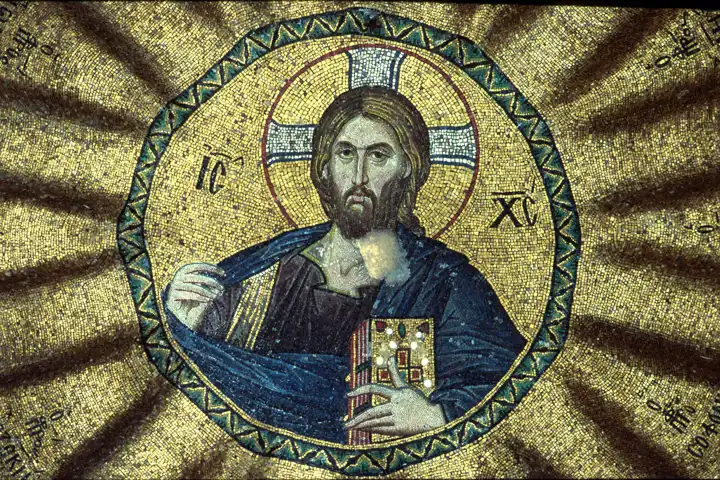

Treasures Of The Caucasus

Travel designer Trista Gage journeys through Georgia and Armenia, savoring flavorful cuisine and immersing herself in ancient faith.

The Southern Front: World War 2 Sites in Italy

Discover WWII sites in Italy, from Anzio and Monte Cassino to Naples and Livorno. Follow the Italian Campaign’s historic battles, memorials, and resistance.

The Eastern Front and the Holocaust: WWII Sites in Germany and Poland

Trace the powerful legacy of WWII through the Eastern Front and Holocaust sites across Germany and Poland.

For El Amor of Mexico City

Amy Willis explains why Mexico City continues to capture her heart and imagination.

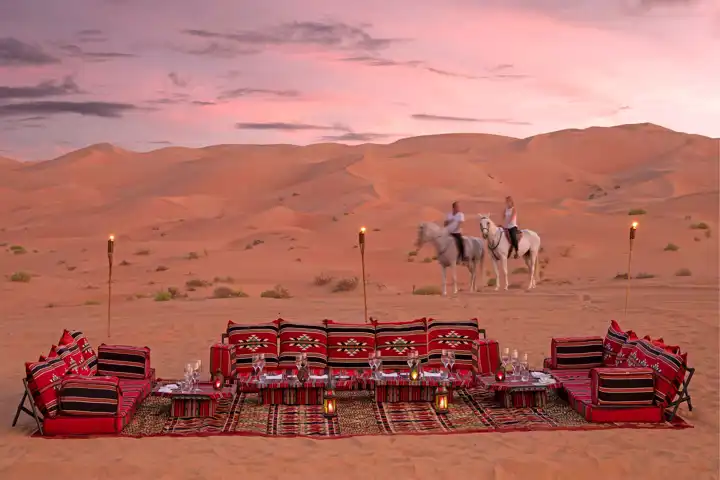

Sand, Sun, and Splendor: Your Ultimate Guide to Abu Dhabi

Where opulent luxury blends with a rich tapestry of cultural heritage, world-class museums stand alongside bustling souks, and the silence of the dunes gives way to the city's vibrant energy.

The Western Front: A Guide to World War II Tours in Europe

Step back in time with this immersive guide to World War 2 tours along the Western Front.

Antartica's Hidden Gems

Discover tours to Falkland Islands and South Georgia and beyond with Ker & Downey. Learn about the extraordinary experiences the Falkland Islands, South Georgia Island, and Snow Hill Island can offer and how Ker & Downey can take you there.

Four Ker & Downey Designers Named Condé Nast Traveler Top Travel Specialist 2025

Ker & Downey’s presence on the prestigious list has grown from one travel designer in 2024 to four designers in 2025.

Croatia With Ker & Downey

Explore stunning Adriatic coastlines, historic towns, and hidden gems across multiple countries — all in one seamless, luxury itinerary.

Unique Wildlife Experiences in Australia

Whether you're short on time or ready for an island adventure, here are four must-visit destinations for unforgettable wildlife encounters in Australia.

The 2026 Eclipse Over Greenland, Iceland, and Spain

Witness the 2026 eclipse in stunning destinations like Greenland, Iceland, or Spain. Explore curated luxury travel experiences with Ker & Downey, blending cosmic wonder with unforgettable landscapes.

Greenland Expedition Cruise: Catherine's Trip Report

Ker & Downey Travel Designer Catherine Brown recently experienced a Greenland expedition cruise. Learn about her thrilling experiences and her tips on the best time to travel to Greenland.

Family Fun: A South African Private Villa Safari

Experience the perfect blend of family fun, stylish accommodations, and thrilling activities on a private villa journey through Cape Town, the Thornybush Game Reserve, and the Waterberg in South Africa

My South African Adventure

Ker & Downey Travel Designer Jamie Bell shares why she loves returning to Africa, time and time again.

Beyond the Bush: Exploring Cape Town

Embark on an unforgettable African safari in Cape Town and its surrounding areas, where you can experience everything from pristine beaches and ancient Bushmen rock art to thrilling shark diving and luxury safari lodges.

Walking Safaris in South Africa

Ker & Downey Travel Designer Trista Gage shares why a walking safari is one of her favorite things to do on a luxury African safari in South Africa.

A Day in the Life on a South African Safari

Discover the magic of an African safari as Ker & Downey's own Haley Beham recounts a day in the life on a South African safari adventure.

6 Best South African Safari Spas

From safari to spa: Ker & Downey shares its top picks for the best African safari spas in South Africa.

6 Reasons Why You Should Visit Panama

Ker & Downey outlines why luxury travelers should visit Panama. From easy connectivity to world-class accommodations, Panama has it all.

The Top Things to Do in San Miguel de Allende: A Travel Guide

San Miguel de Allende is a city that captivates travelers with its well-preserved colonial architecture and dynamic cultural offerings. In this San Miguel de Allende travel guide, we’ll explore some of the top things to do in this UNESCO World Heritage site.

The Maasai Olympics

The Maasai Olympics are a biennial event making strides to change the Maasai culture of lion hunting for status encouraging warriors to 'hunt for medals, not lions."

Southern Africa Packing List

Our Southern Africa packing list provides you with a good guideline for what to pack for your trip to South Africa, Botswana, Namibia, Zimbabwe, Zambia, and Madagascar.

East Africa Packing List

Our East Africa packing list provides a good guideline for what to pack for your safari to Kenya and Tanzania.

Primate Trekking Packing List

This Africa packing list gives a good guideline for what to pack for primate trekking safari in Rwanda, Uganda, and/or Republic of Congo.

Tanzania Safari for Families: An Unforgettable Adventure for All Ages

They've seen The Lion King and Mufasa, but now it's time to see the stars of the show in the wild. Embark on a family Tanzania safari and discover a sanctuary for wildlife while pursuing adventure and lasting memories.

The Ker & Downey Guide to Beating Jet Lag

Traveling across time zones can be a thrilling adventure. However, one challenge even the most seasoned travelers face is jet lag. Here's how to minimize jet lag and make the most of your journey.

The Trend: Thrifty Trips for Two

Romance is in the air! Here's our guide on where to go for a reasonably priced romantic escape.

Costa Brava: A Mediterranean Masterpiece

Costa Brava is Northern Spain’s coastal Mediterranean gem, just shy of two hours from Barcelona. Here's our guide to make the most of your time in Costa Brava.

A Mini Guide to Exploring the Wonders of Off-Season Travel

Rethink your travel plans with our guide to traveling during the off-season. Discover hidden gems, immerse yourself in local culture, and savor the freedom of exploring without the frenzy.

2024: Another Amazing Year of Travel

Journey along with us as we look back at another amazing year in travel.

Awakened India

From chaotic Delhi to sacred Varanasi, Travel Designer Catherine Brown recalls why India is one of her favorite countries.

Costa Rica's Best-Kept Secrets

For such a popular travel destination, Costa Rica still has plenty of surprises left to uncover.

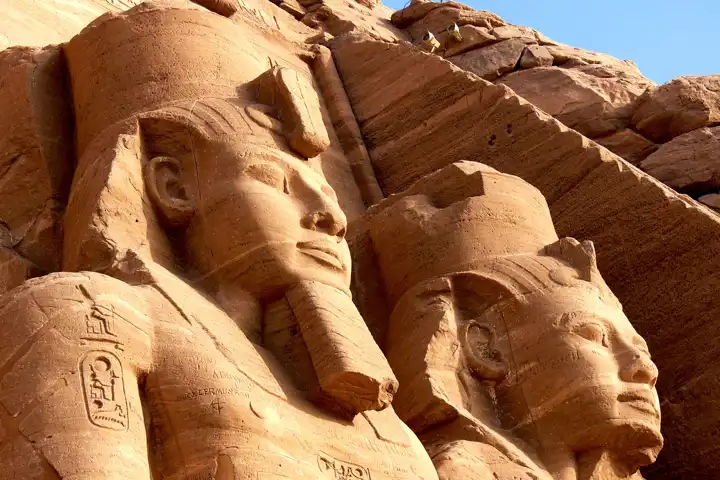

Down the Nile

Experience the land of pharaohs by water on a luxury Nile River cruise.

Australia - Our 2025 Destination of the Year

In 2025, we invite you to discover Australia with Ker & Downey.

AmiLynn's Peru Trip Report

These are AmiLynn's Peru travel tips based on her recent journey through Lima, the Sacred Valley, Machu Picchu, and Cusco.

The Big Five Conservancies

As Seen in QUEST Magazine: How five Kenya conservancies are preserving land, wildlife, and culture for generations to come.

Where to Stay in Australia: Luxury Lodges of Australia

Comfort meets adventure in Australia with a collection of exceptional accommodations that blend indulgence, sustainability, and unparalleled access to some of the country’s most iconic landscapes.

Ishikawa Travel Guide

Experience luxury ryokans, cultural treasures, artisanal crafts, delicious cuisine, and more when you travel to Kanazawa and Kaga in Japan's Ishikawa Prefecture.

Below the Surface

Why Visiting Wyoming in the winter offers more than ski slopes and hot toddies.

Arrivals: New Hotel Openings and Revamps, Fall 2024

The Latest Hotel Openings, Revamps, and Travel News, as featured in the Fall 2024 Off Season Issue of QUEST Magazine.

The Best Dining Experiences Around the World

Go on a culinary journey that takes you to the far corners of the world, where dining becomes not just a tasty experience but a full-body experience that uses all your senses.

South Australia: Wine, Wildlife, and Wonderment on Kangaroo Island

Ker & Downey’s South Pacific Product Manager Vanessa Niven recaps a delightful journey through South Australia in the off season, learning firsthand why Australia truly is a year-round destination.

Sri Lanka Travel Guide

Ker & Downey’s Rina Chandarana shares why luxury travelers should add this island nation to their travel bucket list.

Magellan Discoverer

The Magellan Discoverer, launching in 2026, will become the most innovative Antarctica expedition cruise vessel sailing the White Continent.

How to Choose Your Perfect Destination

Imagine planning your next luxury vacation package—the excitement of new places, relaxation, and adventure. Choosing the perfect destination is the first step in making it unforgettable. Whether you’re dreaming of sunny beaches, cultural experiences, or thrilling adventures, finding the right spot takes a bit of thought.

Top 10 Tips for Planning Your Luxury Journey

Top 10 Tips for Planning the Ultimate Luxury Journey: Elevate Your Travel with Exclusive Destinations, High-End Experiences, and Expert Advice

Your Ultimate Guide to Traveling with Ker & Downey

Traveling with Ker & Downey is easy and streamlined—we simplify luxury travel packages to give you a tailored experience anywhere in the world.

The Ultimate Patagonia Packing List

From glaciers to forests and vast plains to peaks, your Patagonia packing list needs to reflect the region's many terrains and weather conditions. Follow Ker & Downey's guide to help you discern what to pack for Patagonia.

The Benefits of an Antarctica Small Ship Expedition Cruise

Small ship expedition cruises offer a range of benefits, from high guide to guest ratios, more time for shore excursions, and environmentally friendly practices.

Africa in 2025

Discover why 2025 is the ideal year to visit Africa. Explore unique travel opportunities, top destinations, and custom itineraries tailored to your dream African experience.

Spend Christmas in London

Spend Christmas in London with Ker & Downey. Explore some of our favorite holiday experiences, including ice skating, festive market shopping, glass-roof cab tours, and more.

The World's Most Elusive Wildlife

Discover the world's most elusive wildlife. If you’re ready to move beyond the usual Big Five safari suspects, we’ve put together a list of some of the rarest and lesser-known animals worth traveling for.

Property Spotlight: Rumbak Wildlife Lodge

Intrepid travelers with a sense of adventure and a love of elusive wildlife will no doubt enjoy Rumbak Wildlife Lodge on the edge of Hemis National Park in Ladakh, Ker & Downey's favorite place for snow leopard trekking.

Where to Travel in 2025

Pack your bags and prepare for a journey, as we present the top travel destinations for 2025.

Top Waterfalls of the World

Escape into nature’s raw beauty exploring some of the world’s most stunning waterfalls. With well-over 7,000 documented waterfalls in the world, we narrowed the list by focusing on the best waterfalls to visit at the start of the year.

How to Plan a Europe Trip in 2025

Major change is afoot for travel to the United Kingdom and European Union in 2025. Before you plan a Europe trip next year, make sure you are up to date with all of the new entry and exit protocols.

Book & Save Opportunities

Take advantage of exciting offers for the end of the year!

Travel to the Caribbean in the Spring

Here are all the reasons why you should consider spring travel to the Caribbean.

Douglas Mawson

The Douglas Mawson is a purpose-built Antarctic and Arctic expedition cruise vessel traveling to the world’s most remote regions.

What’s the Best Antarctica Cruise?

Ker & Downey outlines how to plan a trip to Antarctica based on your flexibility, budget, on- and off-board experience preferences, and wildlife priorities.

Summiting Tanzania’s Roof: An Unforgettable Kilimanjaro Climb

Climbing Mount Kilimanjaro is a bucket list item for many adventure travelers. And rightly so. It’s the highest peak in Africa, yet its summit is very accessible. Explore the best way to climb Mount Kilimanjaro with Ker & Downey.

Quiz: What is the Perfect South African Safari for You?

Here are some options to consider and some questions to help determine which safari may be a perfect fit for you.

Property Spotlight: Singita Mara River Tented Camp

Located on 98,000 acres of untouched wilderness in the Lamai Triangle of Serengeti National Park, Singita Mara River Tented Camp in Tanzania is an elegant retreat that allows guests to meaningfully connect with nature and encounter the abundance of resident wildlife.

Property Spotlight: Hotel The Mitsui Kyoto

A gorgeous hotel and living piece of Japanese cultural heritage, Hotel The Mitsui Kyoto is one of Ker & Downey's favorite places for clients to experience in Japan.

Southern African Safaris: Luxury Tented Camps vs. Lodges

Here is a comprehensive guide to how luxury tented camps differ from luxury lodges and the benefits of each accommodation.

Patagonia Travel Guide: Argentina or Chile?

Ker & Downey's Patagonia Travel Guide helps you decide which parts of Argentinian and Chilean Patagonia are best for you.

Hermes: Galapagos Mega Catamaran

Launching in 2025, the Hermes Mega Catamaran is an ultra-luxury vessel designed and built specifically to navigate the Galapagos Islands.

Beyond the Serengeti: Exploring Tanzania's Diverse Safari Destinations

Tanzania’s Serengeti National Park is the country’s most popular destination for a safari. But there’s so much more to Tanzania than the Serengeti. In this guide, explore some of the lesser-known safari regions in Tanzania.

Why Book a Luxury Caribbean Beach Holiday with Ker & Downey

Ker & Downey offers a one-stop-shop for your next Caribbean vacation. Here's why you should book a luxury Caribbean beach holiday with Ker & Downey.

Property Spotlight: Khwai Lediba

Nestled in the heart of Botswana’s pristine wilderness, Khwai Lediba is a luxury safari camp that promises an immersive and unforgettable African adventure.

Tanzania's Enchanting Tarangire: A Paradise for Elephant Lovers

One of the smaller parks in Tanzania, Tarangire is a breath of fresh air to the Tanzania safari adventurer. It also has one of the most prolific elephant populations in all of East Africa.

Milestone Birthday Trips: Celebrate in Style

Whether you’re looking for an adrenaline-fueled adventure or a peaceful retreat, this guide has the perfect milestone birthday trip ideas for every decade.

When to Travel to Australia

Discover our tips for when to travel to Australia with Ker & Downey. Read on for a guide to year-round travel in Australia.

Everything You Need to Know About Traveling with Ker & Downey

Have you ever imagined a journey that is not just a trip, but a collection of extraordinary experiences that create memories to last a lifetime? Ker & Downey is a leading luxury travel company offering the world’s most innovative and inspiring luxury travel experiences.

Tanzania Safari Adventure: Witnessing the Great Migration

Embark on an unforgettable Tanzania safari to witness the awe-inspiring Great Migration, where over 1.5 million wildebeest and 250,000 zebras embark on an extraordinary journey of survival.

Discover the Ngorongoro Crater: The Cradle of Life in Tanzania

The world-famous Ngorongoro Crater Area lies at the eastern edge of the Serengeti just west of Arusha in northwest Tanzania. There you'll find one of the world’s most unchanged wildlife sanctuaries on a Tanzania safari.

Unveiling the Serengeti: Tanzania’s Wildlife Spectacle

Journey into the heart of Tanzania and discover the breathtaking beauty of the Serengeti National Park.

Why You Should Charter a Yacht in Croatia

Ker & Downey’s Tiffany Dunn shares her surprise and delight after experiencing Croatia by private yacht.

Beyond the Temples of Angkor Wat

Explore Cambodia beyond the Temples of Angkor Wat. These jewels of Khmer artistry are just a peek into Cambodia’s history and culture.

Botswana Safari Honeymoon: Romance Under the African Sky

Botswana is a land of natural wonders and rich cultural heritage, making it an ideal destination for an unforgettable honeymoon safari and romantic escape.

Travel to India's Golden Triangle

Experience the best India luxury vacation in the Golden Triangle. Comprising Delhi, Agra, and Jaipur, this iconic circuit offers promises the perfect luxury India travel itinerary in under 10 days.

Botswana Safari: Unveiling the Jewel of Southern Africa

Botswana, a land of captivating contrasts and breathtaking beauty, invites you on an unforgettable safari to discover the spectacular wildlife, diverse landscapes, rich cultural heritage, and luxurious lodges and tented camps.

Makgadikgadi Pans: A Botswana Safari Adventure Beyond the Delta

Discover the Makgadikgadi Pans, Botswana's hidden gem beyond the famed Okavango Delta! This extraordinary region boasts vast salt flats, moon-like terrain, and unique wildlife encounters.

Chobe National Park Safari: Witnessing Herds of Elephants

Witness the awe-inspiring herds of elephants, the largest in Africa, during a thrilling safari in Chobe National Park, Botswana's wildlife paradise.

Luxurious Lodges on a Botswana Safari: Where Wildlife Meets Opulence

Experience the ultimate Botswana safari at these luxurious lodges, where top-notch service, culinary delights, and unforgettable activities await.

Moremi Game Reserve: Botswana's Predator Paradise

Explore the breathtaking Moremi Game Reserve in Botswana, home to diverse wildlife and stunning landscapes. Experience thrilling safaris and create unforgettable memories in this African paradise.

The Complete Guide to Planning Your Botswana Safari Adventure

Interested in embarking on a Botswana safari? We’ve got everything you need to plan an unforgettable trip to Africa with your loved ones!

Italy Travel Guide

Thinking about traveling to Italy? Ker & Downey breaks down the key tourism regions in the country to ensure an effortless trip. This is Ker & Downey's ultimate Italy Travel Guide, with an Italy map including seasons and travel tips.

Family Fun in Botswana: A Multigenerational Safari Experience

Whether you have young children or are traveling with older adults, a Botswana safari will be your family’s most memorable vacation. Here's why.

Pantanal Unveiled: Brazil's Best-Kept Wildlife Secret

Embark on an extraordinary adventure into the heart of Brazil's Pantanal to discover the captivating wonders of this overlooked wildlife haven, from majestic jaguars to the vibrant tapestry of its sprawling wetlands.

Octant Furnas Hotel

Lauded as one of the best spa hotels in the Azores, Octant Furnas Hotel provides a luxurious retreat on São Miguel, the Azores’ largest island. This Azores luxury hotel sits within the Furnas Valley, home to the largest concentration of thermal waters in Europe.

Botswana Safari for Adventurers: Witnessing Wildlife Wonders

Explore the diverse landscapes and abundant wildlife of Botswana, from lush wetlands to arid deserts, and witness unforgettable wildlife encounters on your safari adventure.

Botswana Luxury Safari: Unforgettable Encounters in Unparalleled Comfort

For striking views, unique habitats, and untouched wildlife, a Botswana safari is the ultimate getaway for couples, families, or individual travelers. Here's why!

Croatia Travel Guide

Thinking about traveling to Croatia? Ker & Downey breaks down the key tourism regions in the country to ensure an effortless trip. This is Ker & Downey's official Croatia Travel Guide.

French Polynesia: Where the Sky Meets the Sea

French Polynesia in the South Pacific is synonymous with dreamy oceanscapes, turquoise waters, and crystal-clear lagoons, and holds great appeal for families seeking an unforgettable and secluded holiday that the whole family can truly enjoy.

Swiss Family Recipe: Your Guide to the Perfect Family Holiday in Switzerland

Idyllic lakes, cobblestone towns, epic mountain summits, historic and efficient railways, iconic cheese and chocolate, and museums galore, Switzerland has all the ingredients to create a truly unforgettable family holiday.

Luxury Tiger Safaris by Ker & Downey

At Ker & Downey, a “safari” extends well beyond the African savannahs.

Where to Go on a Safari in December

Celebrate Christmas on safari in Africa this December and enjoy summer weather with your family and a slower pace than the normal end of year hustle.

Arrivals: New Hotel Openings and Revamps, Spring 2024

The Latest Hotel Openings, Revamps, and Travel News, as featured in the Spring 2024 Family Issue of QUEST Magazine.

A Taste of Franschhoek

Escaping to wine country in the Western Cape reveals more than sophisticated vintages.

A Mother's Memories of Morocco

Ker & Downey Travel Designer Trista Gage shares why Morocco is a destination worth considering for young, curious minds.

The World's Best Hotel Spas

The hotel spa: a sanctuary of serenity amidst the hustle and bustle of travel. This curated list highlights some of the most luxurious and transformative spa experiences nestled within breathtaking destinations.

qualia

At qualia on Hamilton Island in Australia's Great Barrier Reef, discover unparalleled hospitality, breathtaking landscapes, and bespoke experiences.

VIK Chile

VIK Chile sits perched atop Chile’s fertile Millahue Valley. This 22-room avant-garde design hotel melds Chile’s culture, art, wine, and terroir to create an innovative and holistic wine spa experience in the shadow of the Andes Mountains.

Bears and Belugas, Oh My!

Travel to Manitoba for a unique summer break spent amid the resident wildlife, on land and below water.

Everest Base Camp

Climbing the Seven Summits' exclusive Everest Base Camp offers the highest glamping digs in the world. Learn all about this luxury Mount Everest adventure and the five-star experience awaiting at CTSS' Everest Base Camp.

Royal Malewane

As part of the prestigious and award-winning Royal Portfolio family of properties, Royal Malewane in South Africa will exceed every expectation and change the perception of luxury bush accommodations.

The Retreat at Blue Lagoon

The Retreat at Blue Lagoon is a luxurious abode in the heart of one of Iceland's most iconic natural wonders with healing waters, attention to detail, and personalized service.

Where to Go on an African Safari in November

For everything there is a season, and in the safari world, that season is year-round. Here's where to go in November.

Sail Away in These Best Yachting Locations

See more of a destination on one trip when you float the waters on a luxury yacht charter. Here are the best yachting locations around the world with Ker & Downey.

Is Croatia the New Italy?

Move over Italy... luxury Croatia travel is fast becoming the most sought-out travel experience in Europe. Learn why this Mediterranean gem has become a favorite among Ker & Downey clients.

Heritage Travel: Trace Your Roots, Travel the World

Heritage travel is not just about seeing new places, it is about discovering your roots, tracing your ancestry, and connecting with the stories of your past.

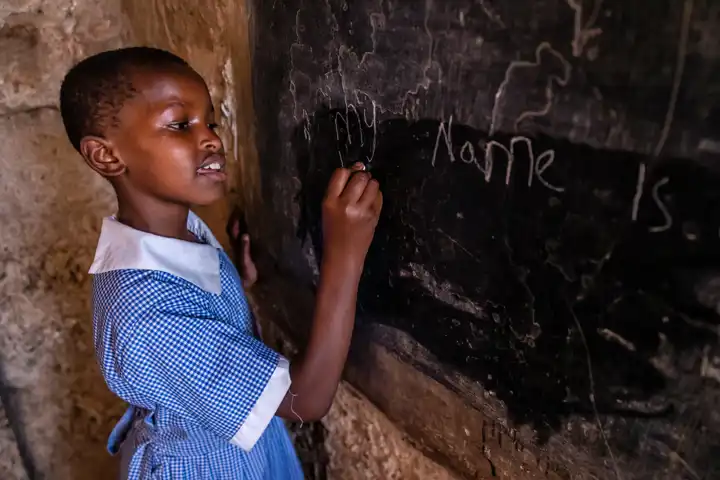

A Ripple Effect - An Opportunity to Give

When Ker & Downey was approached to help send 12 kids to school through the Ripples Foundation during the Covid-19 pandemic, we had no idea the impact it would make.

Ker & Downey Designer Named Condé Nast Traveler Top Travel Specialist 2024

Ker & Downey has been named Travel +Leisure’s World Best Tour Operator in the Travel+Leisure World’s Best Awards.

Kweza Craft Brewery: Brewing a Brighter Future

Kweza Craft Brewery, Rwanda's first craft brewery and a beacon of female empowerment, is not only crafting delicious beers but also paving the way for a more equitable future.

Azores Bucket List

Ker & Downey has compiled the ultimate Azores bucket list to help kickstart your adventure. Here are the 15 best things to do in the Azores.

Green Season in Southeast Asia

Travel to Southeast Asia during the green season to experience a lush world of verdant jungles and colorful festivals.

The Lodge at Blue Sky

The Lodge at Blue Sky, an Auberge Collection Resort, offers an unparalleled retreat for nature enthusiasts and luxury seekers in the heart of the American West.

7 Reasons to Travel to Botswana

Botswana is the ultimate safari destination. If you need a reason to travel to Botswana on your next Luxury Botswana Safari, we’ve got 7 of them.

Everything You Need to Know Before Booking a Botswana Safari

A Botswana safari is a top trip for many, offering some of the best wildlife viewing in the world. Here's what the experts at Ker & Downey want you to know before you plan your safari.

Luxury Family Travel Ideas

These luxury family travel ideas are close to home, eight days or less, and sure to please everyone in your family.

Peru, Our 2024 Destination of the Year

In 2024, we invite you to discover Peru, our Destination of the Year, with Ker & Downey. Peru's rich history, breathtaking landscapes, and vibrant cultures are ripe for exploration.

Lima Travel Guide

Travel to Peru with Ker & Downey to experience the capital city's historic city center, sweeping waterfront, artistic outer reaches, bohemian Barranco district, and delicious cuisine.

Hiking in Peru: Discover the Soul of Peru

Ker & Downey's Sara Kramer discovers Peru on a lodge-to-lodge trek in the Andean Mountains.

Travel Trends in 2024: An Extraordinary Year Ahead

A look back at a record year for travel in 2023 and a projection for travel trends in 2024.

PUQIO, Colca Canyon

Deep in the heart of the Colca Canyon, PUQIO luxury tented camp is the first of its kind in the region.

Guide to U.S. National Parks

Go off the beaten path and venture to one of these lesser visited National Parks in the western United States.

Grand Canyon Mini Travel Guide - Wonders Beyond the Rim

The Grand Canyon is a highly sought-after travel destination in the American Southwest. Our mini guide explores the wonders of the Grand Canyon beyond the rim.

Southern Ocean Lodge

The Southern Ocean Lodge, a world-renowned luxury lodge, has reopened its doors to guests after the devastating bushfires on Kangaroo Island in 2020.

Explore the Best of 2023: Our Top 10 Travel Blogs

As the year draws to a close, we're taking a look back at some of our most read and loved articles. This curated list is your ticket to an expedition around the globe.

Best Things to Do in Ireland with Kids

From puffins and ghosts to chocolate and music, these are the best family activities in Ireland.

Croatia Family Yacht Charter

Six reasons why you should book a luxury yacht charter in Croatia for the whole family.

Waiheke Wanderlust

A travel guide to New Zealand's Waiheke Island. Discover paradise on New Zealand's hidden gem.

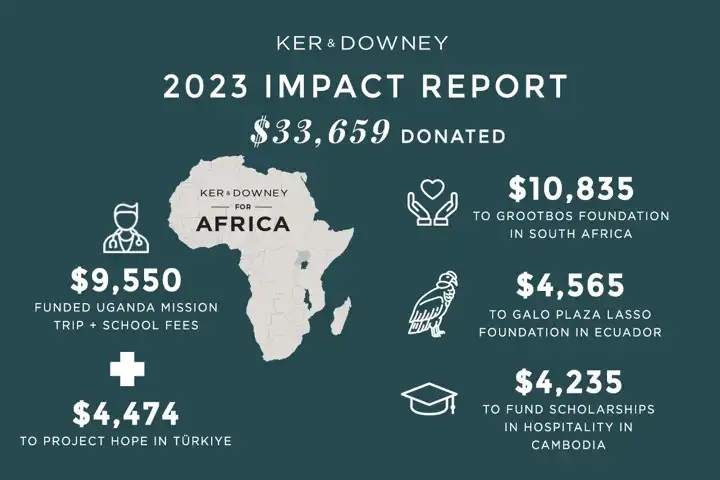

Ker & Downey's 2023 Impact Report

Traveling with Ker & Downey changes lives. Thanks to you, we were able to give back in a significant way in 2023.

Marvels of Malta

The Maltese Islands are the quintessential jewel of the Mediterranean. Here's six reasons why Malta should be on your list.

Best Luxury Hotels in Peru

Here are some of the best luxury hotels in Peru, specifically those under the Relais & Châteaux patronage. These locally owned, boutique luxury hotels promise uncompromising luxury and an authentic sense of place.

South America Packing List

Preparing to travel to South America? Here is our essential South America packing list for a 10-14 day trip.

Top Wildlife to See in India

We unveil our top seven extraordinary wildlife sightings in India, some of which must be witnessed to be believed!

Galapagos Travel Guide

Everything you need to know about travel to the Galapagos Islands: land vs. sea options, vessel considerations, and the best time to travel to the Galapagos.

Where to Go in Africa in 2024

Offering incredible safaris experiences without the crowds, here's the five African destinations that should be on your list for 2024.

UNESCO World Heritage Sites to Add to Your List

Here are seven of the newest UNESCO World Heritage sites and how you can include them on your next Ker & Downey journey.

Kigali Serena - Ker & Downey

Experience elegance and hospitality at its finest with Kigali Serena Hotel with Ker & Downey. Discover luxurious accommodations, exceptional service, and a central location in Kigali. Book your stay for a perfect blend of comfort and convenience

One&Only Nyungwe House

Designed to integrate into the surrounding environment, the One&Only Nyungwe House is perched on a tea plantation at the edge of the rainforest. Relax mere steps away from hiking and tracking the abundant primate species that call the forest home when you stay at this luxury Rwanda lodge.

Singita Kwitonda

Sitting snug between Volcanoes National Park and fertile agricultural land, Singita Kwitonda serves as a buffer between the two. Guests can renew and regenerate at this serene lodge in the shadows of Rwanda's misty mountains.

What to Pack for a Jaguar Safari in the Pantanal

Six days in the Pantanal? Here's what to pack.

Jaguar Safaris in the Pantanal

David Marek, President of Ker & Downey, shares his thoughts on jaguar safaris in the Pantanal, and how it compares to and African safari.

Unexpected Last Minute Escapes

Our team of travel connoisseurs has scoured the globe to bring you the crème de la crème of last-minute escapes that promise to turn your spontaneous desires into unforgettable journeys.

Twala Cultural Manyatta - The Story of Rosemary Nenini

What started as a dream has turned into a movement.

All About Lausanne

Experience the best of the Swiss city -- where to stay, what to do, and what to eat and drink.

Northern Reaches

Travel to Northern Canada – an unpretentious, untamed land where the locals have a story to tell to those adventurous enough to hear it.

Regenerative, Remote, Rewarding

Why Ecuador's sustainable practices, hidden treasures, and diverse landscapes make this country a must-see.

Among the Greats

Exploring the many UNESCO World Heritage Sites of the Republic of Türkiye.

Animals of the Arctic

Ker & Downey General Manager Tiffany Dunn shares the "surprise and delight" of her safari-like encounters with the animals of Spitsbergen.

The Shot: Northern White Rhino

One picture, one moment, one memory captured by Photographer Mark Williams.

Where to Travel in Europe in 2024

These destinations in Europe are worth considering for your 2024 travel plans.

The Endangered Giants: Where to See Rhinos

We delve into the remarkable world of rhinoceroses, their critical role in ecosystems, and the alarming challenges they confront in their battle for survival.

Winter Travel Guide

Traveling in winter offers benefits like incredible scenic beauty, fewer crowds, unique activities, cultural experiences, and even holiday festivities. We explore some of our favorite winter getaway experiences that you can plan now.

Big Cats of India

Conservation programs in the country have resulted in an uptick in the number of big cats across India’s national parks.

Botswana Luxury Safaris

Botswana is a country of striking physical beauty. A multitude of unique habitats coupled with rich bio-diversity make it an ideal destination for Botswana luxury safaris.

Tunisia: Unknown Africa

Tunisia isn’t the first to come to mind when the continent is mentioned, but there are plenty of reasons why it should be for a traveler seeking something beyond a traditional safari.

Kanana

A stay at Kanana is an immersive experience in one of Africa's most pristine and breathtaking landscapes. Experience the best of the Okavango Delta at Kanana.

Where to Travel in 2024

Explore captivating jungles, discover the shimmering kasbahs of the Sahara, and revisit a classic safari spot. Join us as we unveil 2024's hottest travel destinations.

Great Rift Valley in Kenya

The Rift Valley is one of the most awe-inspiring highlights of Kenya, where the crack has literally cut the country in two and created some of the Kenya’s most spectacular lake systems and wildlife habitats.

Renewing Your Passport with Ease

One of the most frequently asked questions we encounter is, "My passport has expired, and I have upcoming travel plans. How can I expedite the renewal process?" We've got your back with answers to this common dilemma.

Asia and When to Travel

From iconic landmarks like Mount Everest and the Yangtze River to ancient civilizations and vibrant festivals, Asia harmoniously blends tradition with modernity. Discover answers to FAQs and the best times to visit Asia in Ker & Downey's Asia travel guide.

Where to Travel in Asia in 2024

Read on for Ker & Downey's suggestions on four Asian destinations that should be on your radar for 2024.

Jinga

Best known for its location on Lake Victoria at the source of the Nile, Jinja is a buzzing little city in eastern Uganda that has quickly risen to become the adrenaline capital of East Africa.

Ker & Downey: Africa Safaris and Adventures

Ker & Downey's Africa safaris are multi-award winning journeys, experienced by discerning clients from across the world, and always carefully hand-crafted by our trusted team of destination specialists.

Fiordland Navigator

Experience the inspiring beauty of New Zealand on the Fiordland Navigator. This one-night Doubtful Sound cruise in New Zealand is an exploration of stunning wildlife.

Dinaka Safari Lodge

Dinaka, a stunning safari lodge, is the perfect place to stay for a Kalahari Experience. Dinaka Game Reserve has so much to offer everyone.

Giraffe Manor

Giraffe Manor is an iconic Nairobi boutique hotel situated on 12 private acres, surrounded by an additional 140 acres of indigenous forest, where the giraffe join you for tea.

Ker & Downey Tanzania

Ker & Downey Tanzania is an East African luxury safari outfitter that specializes in legendary classic tented and adventure safaris in exclusive wilderness areas in Tanzania.

Amangiri

A sleek all-suite hideaway in the heart of Navajo country, Amangiri is both a modernist luxury desert oasis and a Rick Joy designed architectural marvel, surrounded by the ancient geological splendor of some of the country’s most fascinating National Parks and monuments.

All About the Okavango Delta

The Okavango Delta is the lifeblood of Botswana. Immerse yourself in the breathtaking beauty of the Okavango Delta with Ker & Downey's expertly crafted safari experiences.

Kweene Trails – A Botswana Mobile Camp Adventure

Kweene Trails offers unmatched exclusivity in the Okavango Delta. From the mobile safari camp, explore 74,000 acres of Abu Private Reserve.

Where to Travel in Latin America in 2024

These destinations in Latin America are worth considering for your 2024 travel plans.

Japan's Southern Islands

Visiting Japan's southern islands -- Chogoku, Shikoku, and Kyushu -- adds a new layer of depth and breadth to any vacation in Japan.

Shinde

Shinde in Botswana is nestled on a lush palm-dotted island in the heart of the northern Okavango Delta. Delight in the best game viewing and bird watching in some of the most luxurious surroundings in the Delta.

Lake District Travel Guide

Ker & Downey's Nicole Porto traveled to the Lake District in the United Kingdom. Here are her top recommendations in this natural paradise.

Granddaddy Safari

Ker & Downey client Steve Brandon shares his experience traveling to Kenya on a luxury Kenya family safari with his grandkids, his children, and their spouses.

Hot Spots: Luxury Hotels in Croatia

Product Manager Elizabeth Frels explains why you really can have it all with these new luxury hotels in Croatia.

Best Golf Courses Around the World

Explore some of the best golf courses around the world with Ker & Downey. Here are our favorite golfing hot spots, from Scotland to South Africa.

Return to Kenya's Wild

Discover three of Ker & Downey’s favorite private Kenyan safari homes in the wilds of Africa.

Where to Experience Literary and Artistic History in London

Walk in the footsteps of Virginia Woolf, F. Scott Fitzgerald, and Ernest Hemingway.

Our Favorite Latin American Wineries

Ker & Downey's guide to the top Latin American wineries and wine regions, from Chile and Argentina, to Peru and Uruguay.

Trip to Morocco

From the nomadic Berber tribes to the vibrant city life, a trip to Morocco will leave you wanting more.

Where to Go in North Africa and the Middle East in 2024

These three destinations in the Middle East and North Africa are worth considering for your 2024 travel plans.

A Guide to Booking a Safari in South Africa

Deciding where to safari in Africa can be a difficult decision. However, both East African and South African Safaris have their own unique strengths.

An African Safari with Ker & Downey

Everything you need to know to prepare for your upcoming safari with Ker & Downey.

HGTV Renovation Wild

Follow Grant and Lynsey Cummings as they renovate and rebuild their world-renown safari camps in Lower Zambezi National Park in Zambia.

The Trend: Multi-Country Itineraries

Maximize your travels with a seamless multi-country itinerary. Discover how to pair destinations across Europe, Latin America, Africa, and Asia for an unforgettable, efficient, and enriching adventure.

Discovering Jeju Island

Explore the wonders of Jeju Island. From breathtaking landscapes and cultural heritage to luxury accommodations and fine cuisine, discover why this South Korea travel destination is a must-visit.

Plunge into the Wilderness

Exploring the ancient forests, wildlife, and thriving marine ecosystems of Vancouver Island from Clayoquot Wilderness Lodge.

Arabian Nights: Saudi Arabia

Saudi Arabia is opening its doors to all travelers, welcoming them into a fascinating world of deep history and modern delights.

The Guide: Iguazu Falls

Ker & Downey Product Manager Elizabeth Frels reveals the best of the Argentinian side of Iguazu Falls -- where to stay, what to do, and what to eat and drink.

Unique Travel Ideas For Women

This one is for the ladies. To celebrate you, plan a journey around your favorite activity. We’ve rounded up some of our favorite unique travel ideas to get the wheels turning.

FAQs about Legal Travel to Cuba

Ker & Downey answers all of your Frequently Asked Questions about legally traveling to Cuba.

Paradise Found: Lord Howe Island

Just 600 miles to the west of Australia lies the world’s ‘last’ paradise: Lord Howe Island.

Life in the Wild - Dulini Moya

Writer Lauren Kramer recounts her safari experience at Dulini Moya, a private lodge in South Africa's Sabi Sand Nature Reserve.

A Solo Safari Made Simple

Thinking about traveling alone? We spoke with our client who traveled on a solo safari to South Africa.

COMO Shambhala Estate

Escape to Bali and find the ultimate in relaxation and tranquility at the spa retreat and resort, the Como Shambhala Estate, where every detail reflects total healing and calm of body, soul, and mind.

Small Countries, Big Impact

These three countries might be small, but their conservation and sustainability work are making a big impact, not only in their country, but worldwide.

Seven Female-Owned Hotels to Add to Your List

Some of the world’s most iconic hotels are owned by women. These seven female-owned hotels are some of our favorite places to stay in the world. Be sure to add them to your list.

Where to Travel with Your Graduate

Celebrate your graduate in a big way with a big, life-changing journey. Ker & Downey shares five of our favorite graduation trip ideas for travel with your young adult.

2023 Travel and Beyond

A letter from Ker & Downey President, David Marek, reflecting on travel in 2022 and looking ahead to 2023 travel.

Christmas Markets

Discover a few of our favorite lesser-known Christmas Markets in France, Belgium & Germany.

Best Yachts in Croatia

Ker & Downey names some of our favorite yachts in Croatia for island hopping around the Dalmatian Islands. Find the perfect luxury yacht charter for your Croatia journey.

Destinations to Combine with Croatia

Here are five destinations to combine with Croatia for one unforgettable trip.

Galapagos Safari Camp

A few reasons why Galapagos Safari Camp continues to be one of Ker & Downey’s favorite Galapagos experiences.

Casa Grande Hotel

At once charming and chaotic, exploring La Paz can take your breath away. So too will the inspiring confines of Casa Grande Hotel located in the capital city.

GHL Hotel Lago Titicaca

GHL Hotel Lago Titicaca rests on the shore of Lake Titicaca just five minutes away from Puno. It is therefore ideally located to explore the surrounding region and the Uros Islands nearby.

Inkaterra Hacienda Urubamba

Surrounded by 100 acres with mountains towering behind, Inkaterra Hacienda Urubamba is located in the Sacred Valley of the Incas in between Cusco and Machu Picchu.

Palacio de Sal

Palacio de Sal Hotel is built entirely out of salt, in perfect harmony with the surreal landscape of Uyuni.

A History of Ker & Downey

What’s in a name? Well…a lot actually. For Ker & Downey, there’s over 70 years of history behind our name.

Best Time to Travel to Japan

The best time to travel to Japan depends a lot on what you want to see and do. Here's what you should consider for the seasons in Japan.

Where to Travel in 2023

Ker & Downey's top seven go-to destinations for 2023. Our picks take you off the beaten path and to all corners of the world so you can explore more.

International Travel Checklist For Your Next Trip Abroad

Here is Ker & Downey’s international travel checklist to make sure you are ready to travel overseas.

6 of the Best Hikes in the World

Hiking is unquestionably a great way to explore the world. With so much of the world to see, where do you start? We’ve narrowed it down to six of the best hikes in the world.

The Best Treks in the World

Trekking is thrilling, strenuous, and sometime adrenaline-pumping. It is not adventure light. For the truly adventurous, we’ve gathered six of the best treks in the world.

Multigenerational Travel: 8 Places to Please Everyone

We’ve rounded up some of our top spots each member of your family will enjoy. Here are eight of our favorite places for luxury multigenerational travel.

Secrets of Peru

Ker & Downey’s Director of Marketing shares her secrets of Peru and her favorite “off the beaten path” experiences you can do beyond Machu Picchu.

What you can expect for travel in 2022 and 2023

We share our thoughts on travel trends for some of our most popular destinations for 2022 and 2023.

South Africa’s Most Famous 20th-Century Historical Sites and Where to See Them

South African apartheid created a storied past of both struggle and triumph. We share South Africa’s most famous 20th-century historical sites and where to see them.

Where To Go in Latin America

Latin America is having a moment. With its variety of offerings, you may find it difficult to decide where to go. Here are a Ker & Downey's top picks in Latin America right now.

8 Popular Travel Destinations and Where You Should Go Instead

There’s a reason travel destinations are popular. While they are beloved by many travelers, they are getting harder to access or have become overcrowded. Try these spots instead.

Best Restaurants in Latin America

See which of the best restaurants in Latin America made the World’s 50 Best Restaurant list and why you should grab a seat at one of these coveted tables.

Conservation at its Core

Discover Latin America's trailblazing conservation efforts, from breeding Andean condors in Ecuador to expanding the Galapagos Marine Reserve. Learn how communities, governments, and eco-lodges are safeguarding biodiversity and promoting sustainable tourism across the region.

Egypt’s Grand Return

Egypt is experiencing its grand return to tourism’s world stage. Experience the best the country has to offer with private travel to Egypt.

Costa Rica: 2021 Earthshot Prize Winner

Costa Rica was recently named among the first-ever Earthshot Prize winners. Learn why its small size packs a powerful punch.

Encanto: Colombia Travel Guide

Experience “Colombia, Mi Encanto” like never before with Ker & Downey.

5 Quick Getaways from the States

Need a vacation but strapped for time? We hear you. Here are five quick getaways from the States, all seven days or less.

Family Bucketlist Travel

Whether you’re a parent or grand-parent, there is always time to make plans for your future that involve traveling with the entire family.

End Malaria For Good – An Opportunity

A letter from Ker & Downey President, David Marek on our latest efforts to help the people of Uganda.

2022 Travel Outlook

Ker & Downey President David Marek shares his 2022 travel outlook.

The Happiest Places on Earth

What are the happiest places on earth? We polled our staff to see what they believe are the happiest places on earth based on their travels.

Ultramarine

A next-generation polar vessel, the Ultramarine elevates the luxury cruise in Antarctica and the Arctic to new heights of luxury and adventure.

No Man is an Island

Here’s how four of Ker & Downey's partners are putting tourism dollars to work and making a difference in their communities.

Beyond the Borders

Through Rhinos Without Borders, a new generation of rhinos are providing hope for the future of the species in Southern Africa.

Onduli Ridge

Damaraland’s Onduli Ridge sits perfectly poised for tracking desert-adapted wildlife and taking in the country’s stunning natural beauty.

Gifts that Give Back

Our picks for gifts that give back. Give with a purpose this season.

Our Favorite Things - A Holiday Gift Guide

Ker & Downey's travel gift guide, curated by our staff. Here are the most coveted items on our staff's Christmas lists this year.

Best Places to Travel in 2022, by Month

Get your calendars open and start making travel plans. Here are the best places to travel in 2022 by month.

Cirqa

Recharge and refresh in Arequipa at Cirqa, a revival of the original parador, from the geniuses behind Titilaka and Atemporal.

The Singular Patagonia

Established in a cold storage plant-turned-national monument, The Singular Patagonia is strategically placed at the gateway to Chile's beautiful Patagonia fjords.

The Singular Santiago, Lastarria Hotel

The Singular Santiago represents the spirit of Chilean heritage and creativity and is an ideal property for those looking for impeccable style and uncompromising service in the country’s historic capital.

5 Worldwide Festivals and Events to Travel For

Festivals and events give great insight into a community and culture. These are the festivals and events worth traveling for.

The Best Festivals and Events Around the World

It would be impossible to list all the worldwide festivals and events. To help you plan, we’ve hand-selected a number of festivals and events you shouldn’t miss.

Spa Towns of Europe

Only a handful of the UNESCO-protected Spa Towns of Europe remain in their original form. Here are a few worth visiting for their glamorous facilities and picturesque settings.

Where to Travel in December

Create lasting memories with a trip to one of the best places to travel in December.

The Best Travel Experiences Around the World

We've scoured the globe to find the absolute best travel experiences around the world.

Epic Chile

Given its diverse geography, impeccable nature, and all-ages access — it’s not surprising to see why Chile is one of South America's most thrilling countries.

A Marine Safari in South Africa

David Marek shares his South Africa marine safari experience while at Grootbos Private Nature Reserve with his Ker & Downey small group tour.

Royal Chundu Island Lodge

Experience Royal Chundu Island Lodge, a luxury safari camp on the Zambezi River, with Ker & Downey luxury safaris to Zambia.

A Southern Africa Luxury Safari with Friends

Ker & Downey President David Marek reflects on his luxury safari with friends to Zambia and South Africa during the COVID-19 pandemic.

The Newest UNESCO World Heritage Sites You Need To See

UNESCO adds 33 spots to the list of World Heritage Sites in 2021. These are the newest UNESCO World Heritage Sites you need to see.

Gather Around the Table: The Best Foodie Experiences in South Korea

From traditional street food to royal court cuisine, these are the best Korean foodie travel experiences in South Korea.

On Safari in Zambia: Picture Perfect

Ker & Downey president David Marek shares his favorite pictures from his most recent trip to the wilds of Zambia.

South Africa and Zambia Safari: Our Trip to Africa

A South Africa and Zambia safari with Ker & Downey starting in Zambia's national parks and ending with a South Africa safari of note.

One&Only Portonovi

With One&Only Portonovi, a new era of luxury in the Balkans begins.

Farm to Table

Enjoy a fresh escape at some of our favorite farm to table destinations around the world.

Kruger Safari: Everything you Need to Know

A Kruger safari is a bucket-list trip for many people. Beginning, middle, or end - it’s sure to be a highlight on your itinerary. Here’s everything you need to know about a Kruger safari.

South African Safari for the Family: Our Top 5 Picks

After 25-plus years of planning and perfecting, we are finally sharing our top five picks for the perfect South African safari for the family.

South African Safari Travel Diary: Lion Sands Game Reserve

Ker & Downey Designer Nicole shares what makes Lion Sands Game Reserve such a unique and unparalleled South African safari travel destination.

Summer Travel Questions

We are answering your most asked questions about summer travel.

The Pharaohs’ Golden Parade

The Pharaohs’ Golden Parade was one for the ages.

Your South African Safari Guide

This South African safari guide lays out some of the important questions to ask yourself as you are planning your safari.

Favorite Africa Trips from the Ker & Downey Experts

We asked our staff to share their favorite Africa trips.

Layover Dubai

There's no shortage of things to see in this glittering city in the sand.

Planning a Graduation? Celebrate Your Grad with a Safari

Whether starting a new chapter away from home or entering into the workforce, nothing says, “Congratulations” quite like an epic graduation safari.

Magellan Explorer

The Magellan Explorer is a state-of-the-art expedition vessel, specially designed to immerse a maximum of 73 passengers into the wonders of Antarctica.

Top Luxury Family Travel Destinations for Spring Break

Ker & Downey’s top luxury family travel destinations for Spring Break are a respite from busy lives and give you a chance to experience the world through fresh eyes.

Aymara Lodge

Whether you're a wildlife enthusiast, bird watcher, or someone seeking a tranquil escape in nature, Aymara Lodge promises an authentic and unforgettable adventure in the heart of North Pantanal.

Caiman Lodge

Part conservation project, part cattle farm, and part ecotourism lodge, Caiman Lodge brings visitors as close as possible to Pantanal’s nature and culture, from the hyacinth macaw to the elusive jaguar.

Cristalino Jungle Lodge

Nestled in the southern Amazon next to a peaceful river, the Cristalino Jungle Lodge is a secret haven where the passion for unmatched service is surpassed only by the lodge's desire to set the standard in conservation and sustainable tourism.

Hotel Pantanal Norte

Situated on the edge of the pristine Pantanal wetlands in Porto Jofre, Hotel Pantanal Norte beckons nature enthusiasts to the ultimate wildlife haven in Brazil -- the jaguar capital of the Americas.

Hotel Unique

With its prime location, distinctive architecture, avant-garde decor, and top-notch amenities, Hotel Unique stands as a beacon of sophistication in São Paulo.

Rosewood São Paolo

Set in a historic 1904 building that was formerly a maternity hospital, Rosewood São Paulo provides an ideal launching pad for exploration with its proximity to upscale boutiques, cultural institutions, and the city's dynamic energy.

The Ibiti Project

Nature and nurture meld harmoniously at The Ibiti Project. Escape to an outstanding area blessed with waterfalls, peaks, ridges, caves, and natural pools, with artwork interspersed throughout. This is one place you have to see to believe.

Sustainable Properties in Kenya

Environmentally conscious travelers rejoice in Kenya's sustainable camps and lodges. Enjoy an eco-friendly journey to Africa!

The Best Places to Spend Your Babymoon

Our destination specialists can help you plan your getaway for two before the stork arrives. Check out our favorite places to babymoon.

Tracking Wildlife on Mainland Australia’s East Coast

Our tips on how to track and see some of Australia's iconic wildlife on the East coast.

Hacienda Zuleta's Andean Condor Huasi Project

Hacienda Zuleta's Andean Condor Huasi Project is internationally known for their work in rehabilitating the Andean condors.

Ker & Downey named Travel + Leisure’s World Best Tour Operator

Ker & Downey has been named Travel +Leisure’s World Best Tour Operator in the Travel+Leisure World’s Best Awards.

American Safari Camp

Explore the great outdoors without sacrificing luxury or comfort on an American Safari Camp adventure with Ker & Downey.

Where to Fly Camp

Here are our top 3 places to spend a night under the stars fly-camping.

The Most Scenic Drives in the World

Get your motor running and explore the open road with Ker & Downey's list of the most scenic drives in some of the most beautiful places in the world.

Top 8 All-American Travel Experiences

We have assembled our Top 8 All-American Travel Experiences. This is “America the Beautiful,” Ker & Downey style.

The Good Outdoors

If being outside is good for your health, then a trip to the Scottish Highlands with Ker & Downey serves up the best kind of medicine.

Catskills Revival

Ker & Downey designer Catherine Brown trades in international glam for a truly memorable active adventure closer to home in the Catskills.

Rhino Philanthropy Project | Ker & Downey Supports Rhinos Without Borders

Ker & Downey proudly supports Rhinos Without Borders and its goal of relocating 100 rhinos from South Africa to Botswana.

Beautiful Tablescape Ideas from Royal Chundu

Royal Chundu’s Tina Aponte shares her beautiful tablescape ideas and the importance of meaningful dining experiences.

Zambia’s First Dessert

For a six-course tasting menu at Royal Chundu, inspired by the region, the lodge chefs got creative and created Zambia's first dessert.

The Best Father-Son Trips

Celebrate the bond between father and son. Explore our favorite father-son trips from around the world.

16 Jaw-Dropping African Safari Photos (And How We Captured Them)

You don’t have to be a professional photographer to get a great shot on an African safari. Sometimes, it’s just a matter of being in the right spot at the right time.

The Best Mother-Daughter Trips

There is no relationship more precious than that of a mother and a daughter. Celebrate and strengthen those bonds with our favorite mother-daughter trips.

Conservation in Time of Coronavirus

Even through lockdowns and travel restrictions, these conservation champions continued their much-needed work across the globe.

Giving back, locally.

At Ker & Downey our mission remains the same, making lives better in our home, in our communities, and around the world.

Plan Your Family Christmas Vacation

Ditch the usual presents and give the most sought after gift of all — freedom to explore the world.

7 Trips to Book a Year in Advance

There’s nothing more thrilling than a last minute getaway. But some trips require (and deserve!) more time to plan. Here are seven trips to book a year in advance – at least!

Top 7 Reasons Why Families Should Travel to Scotland and Ireland

A Scotland and Ireland family adventure with Ker & Downey showcases why these two countries are a perfect pair for all ages and interests.

The Best Travel Books to Feed Your Wanderlust

From harrowing journeys to tales of whimsy, these are the best travel books to feed your wanderlust until you can take your next adventure.

The Ultimate Gourmand’s Guide to Germany

During the last decade, Germany’s culinary scene has blossomed, making the country one of Europe’s most exciting foodie destinations.

The Top 5 African Safari Experiences

We've curated a list of the top African safari experiences from seeing the Big Five to the witnessing the Great Migration that you won't want to miss.

Ker & Downey's Staff Picks Their Favorite Trips

Want to travel someplace new, but don’t know where to go? Look no further than our worldwide roundup.

Long Layover in Panama - Stopover Panama

The Stopover Panama campaign allows travelers to spend up to seven days in Panama without paying for an extra ticket. The "Hub of the Americas" lives up to it's name.

12 of the Best African Sleepouts for Stargazers

With luxury treehouses, elevated sleep out decks, and star beds attached to your suite, there’s a stargazing experience here for everyone.

Romantic Experiences for Two

Romance is in the air. In celebration, Ker & Downey has compiled a list of our favorite romantic experiences for two around the world.

Valletta Travel Guide

Rina Chandarana explains why Malta's capital Valletta is a city on the sea you need to see. Consider this your ultimate Valletta Travel Guide.

The Pangolin: What It Is and Where to Find It

The pangolin is an elusive creature. We've rounded up 5 places to increase your chances of spotting the pangolin in Africa.

The Bluest Places on Earth

Dive into Ker & Downey's list of the bluest places on earth, from land-based handcrafted experiences to under-the-sea adventures.

Hidden Kingdoms

Product Manager Elizabeth Frels uncovers a rich Maya history deep in the heart of Mexico.

Top Safaris Around the World

Safaris aren’t just for the African bush. We’ve rounded up some of our top safaris around the world to inspire your next Ker & Downey journey.

The Singing Wells

Travel to Kenya and the remote Namunyak region, the only place in the world to see centuries-old Samburu traditions at the singing wells.

The Most Read Blogs of 2019

Here’s what you read the most of in 2019. Which story was your favorite?

Greg’s Ker & Downey for Africa 2019 Trip

Ker & Downey’s Greg Jackson shares his experience from traveling to Uganda with the Ker & Downey for Africa 2019 team.

Frozen Locations to Visit

Baby, it's cold outside... but that's not stopping us from wanting to travel to some frozen locations inspired by the movie Frozen 2.

The Perfect Stocking Stuffers for Travelers

Searching for a gift for the jet-setting wanderer in your life? These great stocking stuffers for travelers have been hand-picked by Ker & Downey experts.

Holiday In The Wild: Elephants, Romance, and Conservation

Settle in for a feel-good flick that will leave you longing for a safari for two.

What to Eat in New Zealand: A Foodie's Fortune

Where to go and what to eat in New Zealand for the tastiest time in Kiwi country.

The Best Travel Gifts for Kids Who Love to Explore

Do you have a little traveler in your family? We've rounded up a list of the best travel gifts for kids who love to explore the world.

Baur au Lac

At Baur au Lac, tradition meets modernity in one of Europe's most sophisticated cities.

The Chedi Andermatt

Nestled in the heart of the Swiss Alps, The Chedi Andermatt combines both modern luxury and Alpine chic charm.

Belmond Andean Explorer

The Belmond Andean Explorer luxury train transports up to 48 passengers through the vibrant cities and natural wonders of Peru on one or two night itineraries.

Luxury Tented Camps Around the World

We’ve rounded up 13 of the most stylish luxury tented camps around the world — no bedroll required.

Explore Ranches

Ker & Downey partners with Explore Ranches as a new way to explore some of the most pristine, privately held land in the United States.

How To See The Real Downton Abbey

A Downton Abbey tour with Ker & Downey allows you to explore various parts of the United Kingdom on your own private journey.

Where to Go on Safari to Avoid the Crowds

Where to go on safari to avoid the crowds. These four locations, Ker & Downey favorites, are sure to be a hit!

All I Want for Christmas

Spanning France, Belgium, Germany, and Austria, some of our favorite European Christmas markets are those found off the beaten path.

Ring in the New Year

In these exciting locations across the globe, the new year starts with a bang, and our exclusive and unique experiences for New Year’s Eve keep the party going.

Senses By the Sea

There were many pleasant surprises for Ker & Downey’s Stephanie and Tess on a life-changing (and mouthwatering) trip to Croatia.

Visiting South Korea with Ker & Downey

What you shouldn't miss when visiting South Korea. Ker & Downey's Vanessa Niven shares the highlights from her trip to South Korea.

A River Runs Through It

A Mekong luxury river cruise to explore Vietnam, Cambodia, and Laos is a great addition to any Ker & Downey custom and tailored itinerary.

Inspiring Israel

Israel feels like geographical & spiritual center of the world. Travel to Jerusalem and beyond with Ker & Downey.

Zanzibar Beaches and Safari

After spending time in the bush, switch gears by heading to the Zanzibar beaches for a few days of beachside luxury and serenity.

Hot to Trot: Great Plains Conservation

Taking a holistic approach to responsible tourism, the Great Plains Conservation safari camps remain among our favorites.

Visit Europe - Six Unique Ideas

With 44 countries in Europe, travelers have plenty of choices. Here are a few unique ideas for your next trip.

Shark Cage Diving: Frequently Asked Questions

Shark cage diving is one of the most thrilling—and unpredictable—travel experiences in the world. We are answering FAQs regarding shark cage diving off the Western Cape in South Africa.

A Journey to Nepal and Bhutan

Ker & Downey Designer Catherine shares highlights and tips from her journey to Nepal and Bhutan.

Where to Go on an African Safari in January

When the weather gets dull and dreary in January, there's several places in Africa you can visit to escape the doldrums.

The Lion King: an African Fantasy

Some very real places played a part in the development of The Lion King, and they are sure to inspire you to see the true African wilds for yourself.

Mendoza Through the Grapevine

Take a sip by sip journey through the Mendoza wineries in Argentina, and discover much more than Malbec. As seen in QUEST magazine.

Top 10 Reasons to Travel to the Galapagos in the Fall

The fall remains one of the best times to visit the Enchanted Islands. Here’s why.

Where to Experience Istanbul's History

Ancient Constantinople is overflowing with sights. These are the can't-miss places where you can experience Istanbul's history.

Beyond the Big Five: Bizarre Animals on an African Safari

The thrill of an African safari is the opportunity to witness wild and wonderful creatures in their natural habitats, from floodplains to fantastic grasslands. And sometimes in the midst of spotting the usual suspects, you may catch sight of something more unique.

With Gratitude: Tipping Guide for Our Most Popular Destinations

As seen in Quest Magazine, a handy tipping guide for everything you ever wanted to know about tipping, but hesitate to ask.

Four Reasons You Should Visit Bangkok with Ker & Downey

Thailand's capital has splashy rooftop pools to frenetic markets, but here are our other four reasons why you should visit Bangkok.

Island Muses

Explore Greece without the crowds, off the beaten path. Ker & Downey's Elizabeth Frels shares her travel secrets with us.

My Personal Luxury Argentina Vacation

Product Manager Elizabeth Frels explains how she was able to personalize her own luxury Argentine vacation, the Ker & Downey way.

Hot Spot: Peru

Between the Amazonian rainforest and Andes Mountains — not to mention its deserts, beaches, world-class cuisine, and pisco liqueur — Peru is a superstar destination beyond its Machu Picchu fame.

Mythical Journey: Travel to Southern Iceland

Trading in her safari attire for winter gear, Ker & Downey’s Nicky Brandon travels to southern Iceland, the Land of Fire and Ice.

Traveling to Cuba with Ker & Downey

The advantages of traveling to Cuba with Ker & Downey: Everything you need to know about Ker & Downey's Support for the Cuban People programs to Cuba.

Sustainable Style: The Cayuga Collection

Find smart luxury close to home. We uncover a true ecological leader in the sustainable luxury hotels of the Cayuga Collection.

Deep Dive in Australia

Go further. Get closer. Discover Australia's amazing water worlds.

Women’s Safari Packing List

Our women’s safari packing list gives you a good guideline for a 10-14 day safari in southern and eastern Africa.

London Getaways

These London getaways prove an ideal option for those short on time but in need of some serious R&R.

Men’s Safari Packing Guide

Here you will find our men’s safari packing list for a 10-14 day safari in southern and eastern Africa.

Worry-Free Travel for Vegetarians

By planning your trip with a Ker & Downey designer, every detail is considered, including your dietary preferences.

Penguins Of The World

Antarctica isn't the only place to see these sharp-dressed birds in action. Explore the many penguins of the world throughout the southern hemisphere.

9 Packing Tips to Get You Through the Airport Quickly

In this post, our Air Department is sharing their top packing tips to make getting through the airport a breeze.

8 Pre-Trip Travel Preparations to Ensure Your Trip Goes Off Without a Hitch

Ker & Downey certainly knows a thing or two about air travel. In this air travel series, we asked our air department experts to share their top tips to make your trip go off without a hitch.

American Spas: Wander Well

These American spas are iconic destinations in their own right, and the perfect complement to rugged exploration. Nothing deepens your earth-body connection like a journey blending the best of nurture and nature. Pack your bags for an American spas getaway amid the Southwest’s celebrated natural landscapes.

Journey to Uzbekistan: A Different World

Take a detour away from the average vacation destination and head to Uzbekistan, once the epicenter of the Silk Road. Ker & Downey designer Nicole Porto explains why you should embark on an enchanting journey to Uzbekistan.

Journey to North Africa

From mountains to deserts and sea, Morocco’s geography is blessed with diversity. Its cities entice with modern museums, flavor-packed cuisine, and maze-like medinas.

A Big 5 Safari – Where to Go

Spotting the "Big 5" on safaris can be challenging… unless you know where to look. Here are our top places in South Africa, Botswana, and Kenya to go on a Big 5 Safari.

Travel To Ethiopia: Forgotten Lands

Long overlooked by tourists, Ethiopia’s rich history, architecture, wildlife, and rugged landscapes make it a destination not to be missed. Ker & Downey’s Rina Chandarana tells us why you should travel to Ethiopia.

Gorgeous Green Spaces

Take a walk in the park and consider including one of the world’s most gorgeous green spaces to your next custom journey.

Top 10 Croatia Experiences

Ker & Downey presents the very best Croatia experiences, many of which are only available by booking with Ker & Downey.

Aladdin-Inspired Adventures

Our journeys throughout the Middle East, North Africa, and Central Asia showcase a treasure trove of Aladdin-inspired adventures; hop on a carpet and fly with us to explore them all.

Vintage French Luxury

Experience vintage French luxury in the heart of one of the most romantic destinations in the world.

A Kenya Safari During the Short Rains

If you approach a safari in the “short rains” season with a sense of flexibility and adventure, you’ll be rewarded with memories to last a lifetime.

Where Would Charles Darwin Travel Today?

We're taking a look at his historic journey on the HMS Beagle and imagining where he might adventure today.

Island Life

This string of African islands just off the coast are loaded with history, culture, wildlife, and loads of postcard-perfect beaches to rival any of the world's best.

Truffle Hunting Around the World

Join Ker & Downey on a journey to find the best places to hunt for truffles, wild plants, and other natural goodies around the globe.

Starstruck: Where the Celebrities Stay

We can help you feel like a star by planning a celebrity-style trip to one of these hot spots where the famous jetset have stayed.

Wellness Retreats Around the World

Feel immersed in serenity and good health at these wellness retreats around the world, where there is nothing on the agenda except relaxation.

Picture Perfect: How to Photograph Animals

An interview with award-winning photographer and QUEST contributor Mark Edward Harris on how to photograph animals, whatever your skills.

Where You Should Spend Next Christmas

Round up the family and head off to this region, where you’ll find timeless treasures to captivate all ages.

Quick Trip: Guatemala

Five days in Guatemala will only scratch the surface of all there is to see and do, but for a quick getaway from the States, it is an ideal destination.

Africa's Safari Darling: Why Zimbabwe Should Be Your Next Safari

With incredible natural beauty, exceptional wildlife variety and some of the friendliest people on the planet, Zimbabwe offers an unrivaled safari experience at a fraction of the cost of its neighboring countries.

Calving Season in the Serengeti

Witness calving season in the Serengeti, where thousands of wildebeest are born each day.

Here’s Why you Should Travel to India for Diwali

Diwali illuminates India every year with color and celebrations. The festival is deeply rooted in several Hindu stories that are exuberantly brought to life across the country in many ways. Here's why you should travel to India for Diwali.

Land of the Morning Calm: What to See and Do in South Korea

History, culture, and kimchi: visiting South Korea offers something for everyone. Here's our guide to what to see and do in South Korea.

Visit the Middle East and North Africa

Travel to the Middle East and North Africa is within easy reach with Ker & Downey. These are just four countries that we feel you should visit while the crowds are light.

Unique Costa Rica Travel Ideas

Ker & Downey offers unique options to jump-start your journey to this Latin American haven.

Asia 2019 Travel – Where To Go Next